39+ can i claim mortgage interest on taxes

Web So lets say that you paid 10000 in mortgage interest. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way.

What Is Debts In Finance Quora

The write-off is limited to interest on up to 750000 375000 for married-filing.

. The 1098 is in someone elses name not a seller-financed loan but you. Web The interest you pay for your mortgage can be deducted from your taxes. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web When entering the 1098 only enter the amount that you actually paid not the full amount. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Companies are required by law to send W-2 forms to.

And lets say you also paid 2000 in mortgage insurance premiums. So your total deductible mortgage interest is. Filing your taxes just became easier.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. Homeowners who bought houses before.

As the receiver the FDIC sells and collects the assets of. Further mortgage payments and. Amid the economic turmoil caused by the coronavirus.

Ad Over 90 million taxes filed with TaxAct. Web For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must be used for generating income whether thats rental income business. Web In the event of a bank failure the FDIC says it has two roles.

750000 if the loan was finalized. Web How you claim the Mortgage Interest Deduction on your tax return depends on the way the property was used. The FDIC insures the banks deposits.

Web Key Takeaways. Web Even though two unmarried individuals can both be the legal owners of the home and pay the mortgage equally or from common funds the lender normally sends. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Web In order to claim the mortgage interest deduction you must have an ownership interest in the qualified property and be responsible for the secured debt. There is no specific mortgage interest deduction unmarried couples can take. Ad Easy Software To Help You Find All the Tax Deductions You Deserve.

Web Homeowners who requested forbearance on their mortgages last year could face tax implications this year. Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way.

Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. File your taxes stress-free online with TaxAct. A general rule of thumb is the person paying the expense gets to take the.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web An equitable owner can deduct interest paid on a mortgage even if they are not directly liable for the debt. Start basic federal filing for free.

Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your homethe. Web Up to 96 cash back Answer No. If the Mortgage Interest is for your main home you would enter the.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Free Legal Assistance Available For Pennsylvania Remnants Of Hurricane Ida Survivors Helpline 877 429 5994 Legal Aid Of Southeastern Pennsylvania

39 92ac Luella Road Sherman Tx 75090 Propertyshark

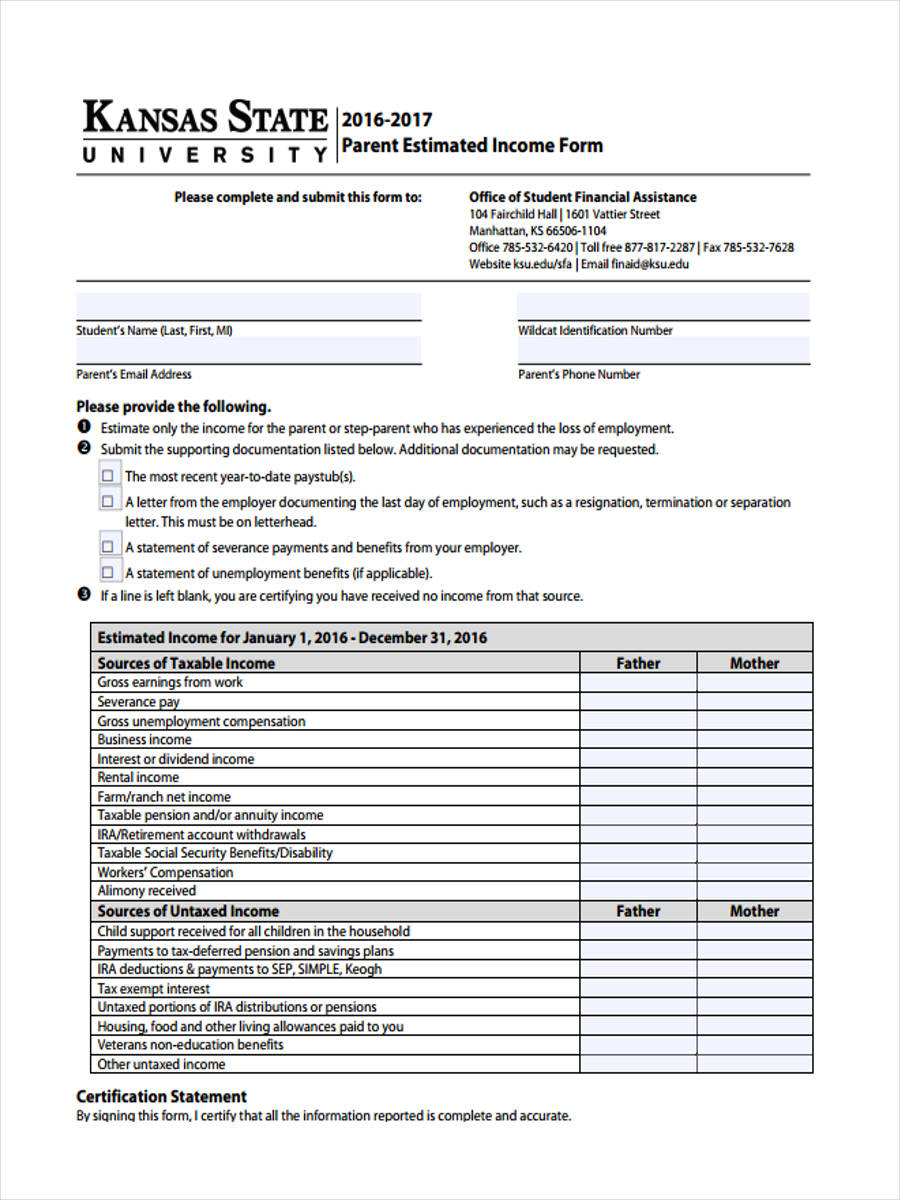

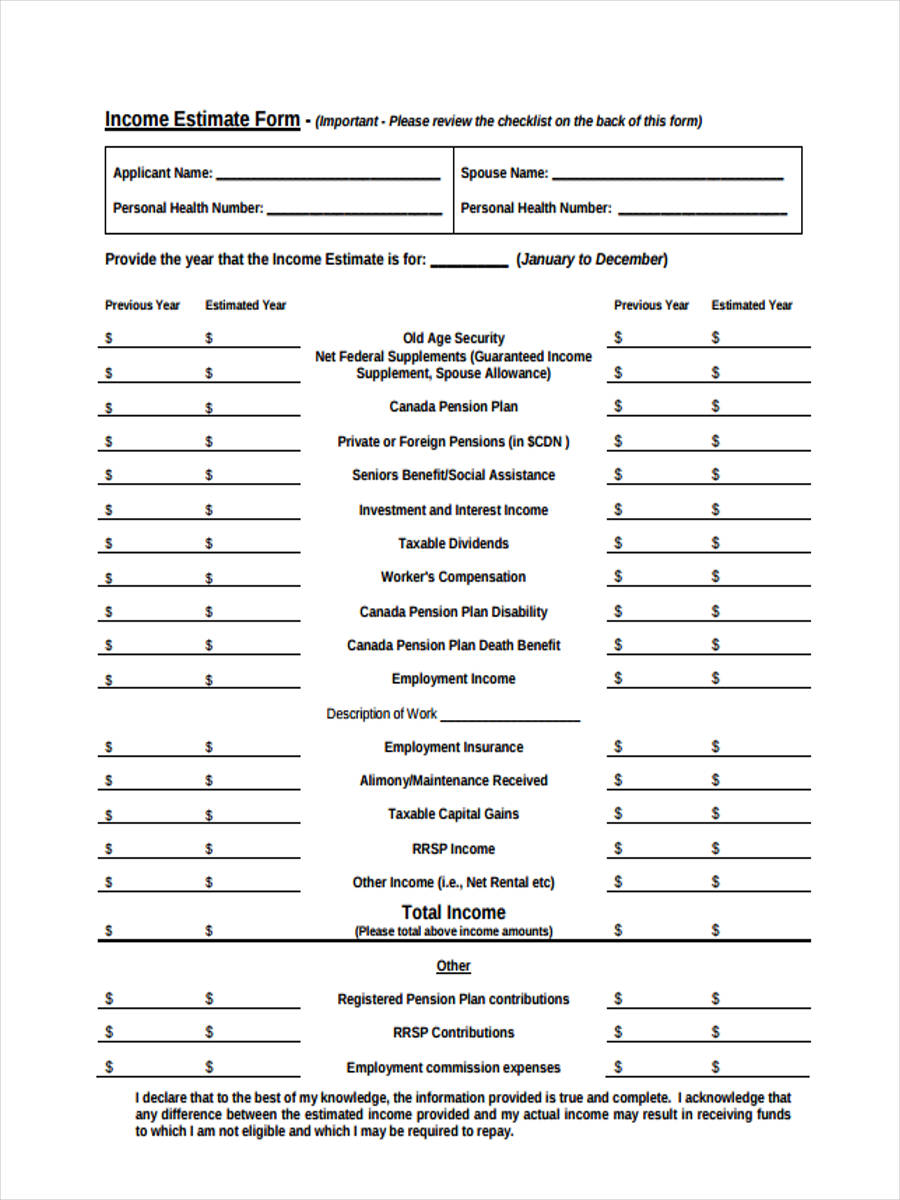

Free 39 Estimate Forms In Pdf Ms Word

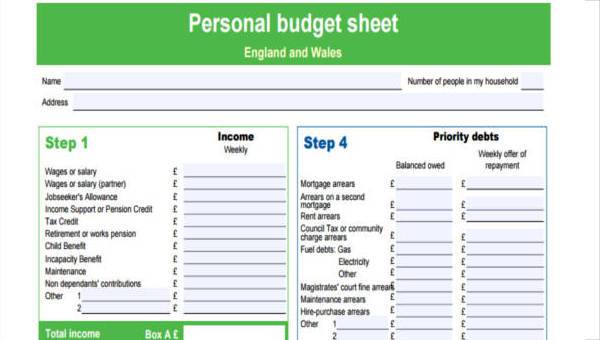

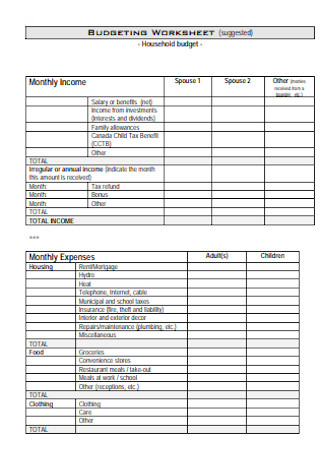

39 Sample Household Budgets In Pdf Ms Word

Can You Claim Mortgage Interest On Taxes Pocketsense

10 Mortgage Form Templates In Pdf Doc

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction And Your Tax Partner What If Your Partner Leaves

Business Succession Planning And Exit Strategies For The Closely Held

Verification Letter Examples 39 In Pdf Examples

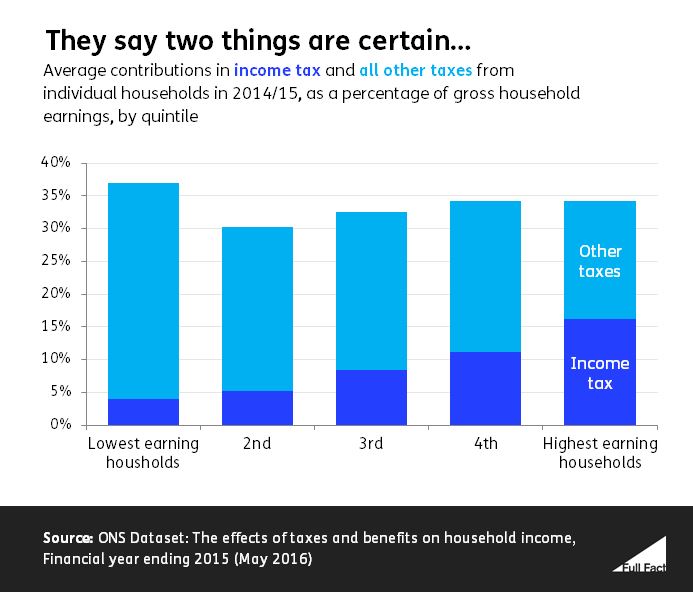

Economy Introductions Income Tax And Who Pays It Full Fact

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Interest Deduction Bankrate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Can I Claim Loan Mortgage Interest As A Tax Reduction Moore