Efile tax calculator

Up to 10 cash back Check E-file Status Track IRS Refund Tax Tools. Personal state programs are 3995 each state e-file available for.

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

Easily manage tax compliance for the most complex states product types and scenarios.

. Ad Accurately file and remit the sales tax you collect in all jurisdictions. Efile tax calculator Sabtu 03 September 2022 Edit. E-file fees do not apply to NY state returns.

If you make 70000 a year living in the region of California USA you will be taxed 15111. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

See it In Action. Ad Accurately file and remit the sales tax you collect in all jurisdictions. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

Easily manage tax compliance for the most complex states product types and scenarios. California tax year starts from July 01 the year before to June 30 the current year. Effective tax rate 172.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

2021 tax preparation software. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

California Income Tax Calculator 2021. Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. State e-file not available in NH.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. It is mainly intended for residents of the US. Ad Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management.

Just answer a few simple questions about your life income and expenses and our free tax calculator will give. Reduce Risk Drive Efficiency. You have nonresident alien status.

Your average tax rate is 1198 and your marginal. Estimate your tax withholding with the new Form W-4P. Because tax rules change from year to year your tax refund.

And is based on the tax brackets of 2021 and. Request Your Demo Today. Estimate your tax withholding with the new Form W-4P.

State e-file available for 1995. Top 5 Tax Refund Calculators To Ease.

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

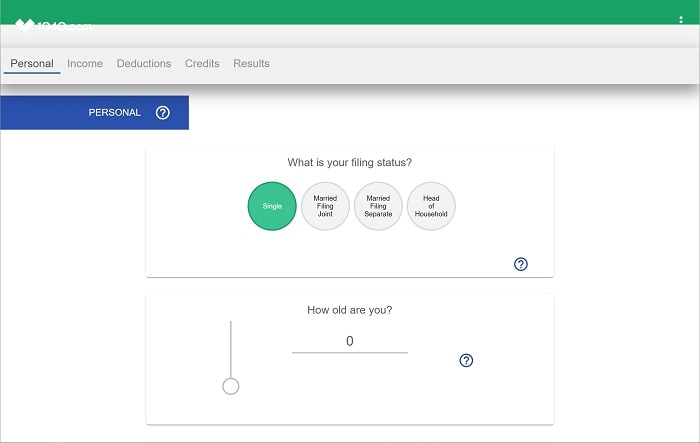

Calculator And Estimator For 2023 Returns W 4 During 2022

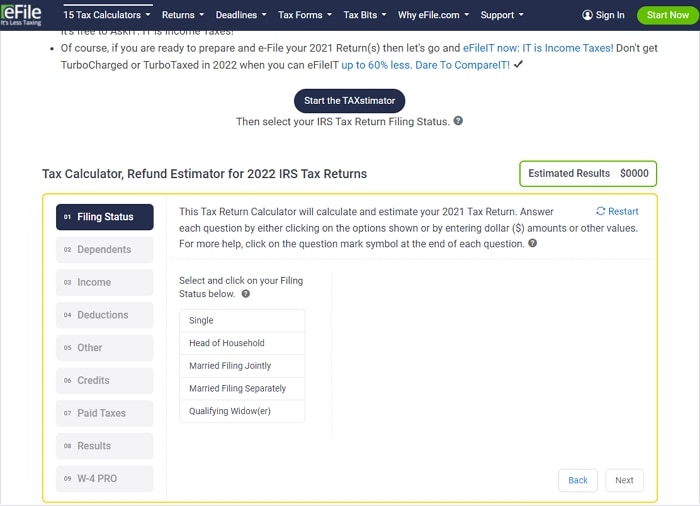

Tax Calculator Estimate Your Taxes And Refund For Free

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

Tax Calculator Estimate Your Taxes And Refund For Free

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

Tax Calculators And Forms Current And Previous Tax Years

Sars Efiling How To Submit Your Itr12 Youtube

Tax Calculators And Tax Forms Estimate And File 2018 Taxes

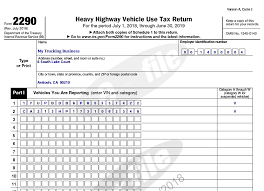

Ytt Llc Form 2290 Efile 2290

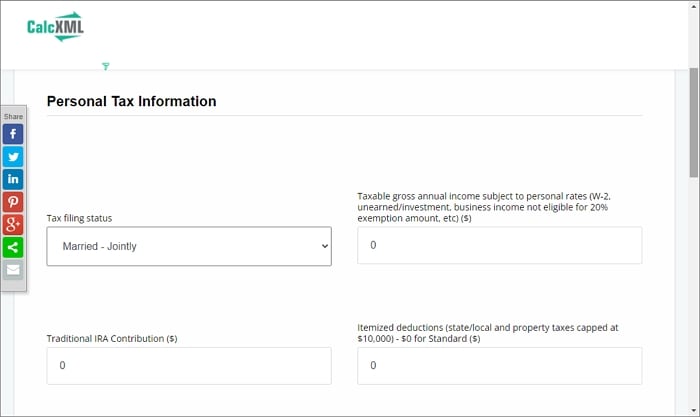

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Tax Year 2022 Calculator Estimate Your Refund And Taxes

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Free E File H R Block

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections